Offshore Wind - The Portuguese Ambition

European Strategy Paves the Way for Portuguese Offshore Wind Ambitions

European nations are increasingly harnessing the power of offshore winds, and Portugal has solidified its position at the forefront of this renewable revolution.

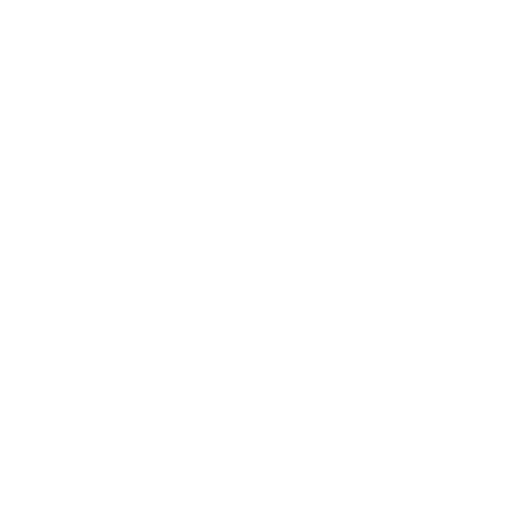

European Strategy: A Unified Vision for Clean Energy

The European Union's latest strategic blueprint stresses the significance of offshore wind energy in achieving the continent's ambitious climate objectives.

Some of the measures are:

Some of the measures are:

- Rapid roll out of solar and wind energy projects combined with renewable hydrogen deployment do save around 50 bcm of gas imports

- New national RepoweEu plans under the modified Recovery and Resilience Fund - to support investment and reforms worth €300 billion

- New legislation and recommendations for faster permitting of renewables especially in dedicated “go-to areas” with low environmental risk

- New EU proposals to ensure industry has access to critical raw materials

- The EU is committed and convinced that it can speed up net-zero industrial transformation at home. New competitive mechanisms (production subsidy) for scaling up manufacturing of components for solar and wind energy, batteries and electrolysers

One of the measures proposed in European Green Deal is to increase the European renewables target for 2030 from 40 to 45%.

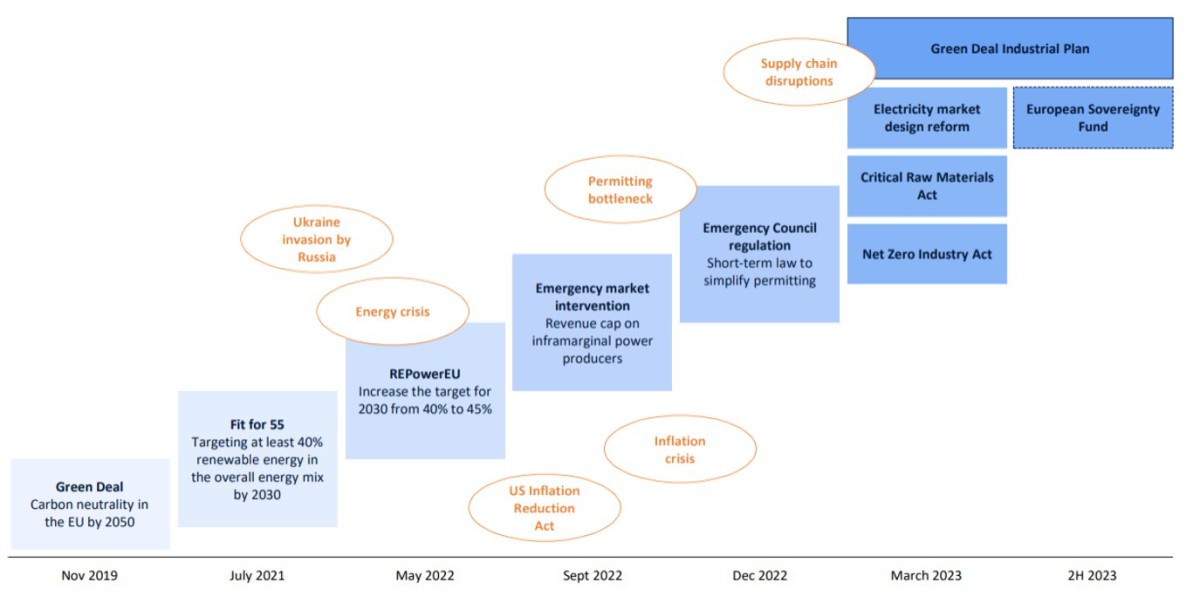

The EU strategy on offshore renewable energy sets targets for an installed capacity of at least 60 GW of offshore wind and 1 GW of ocean energy by 2030, and 300 GW and 40 GW, respectively, by 2050.

Portuguese Goals and Strategy: Leading by Example

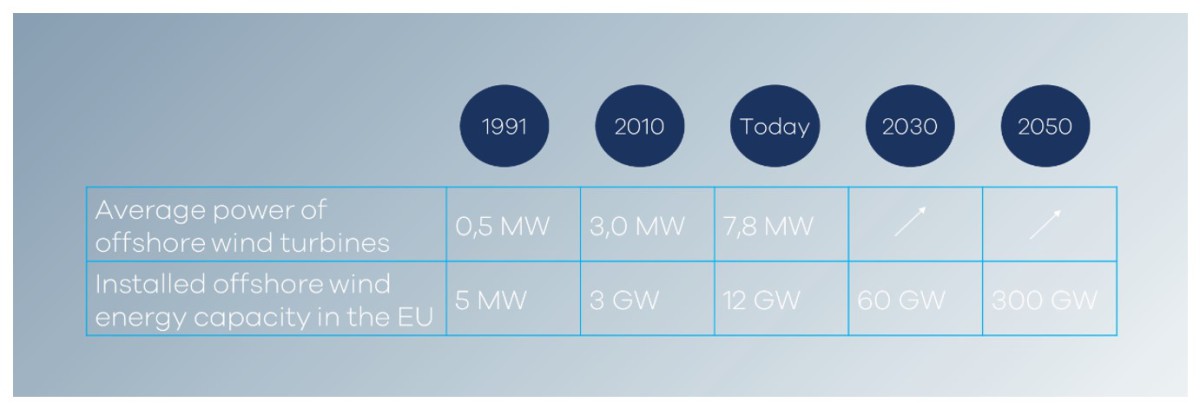

Aligned with the European vision, Portugal has outlined its own ambitious goals. The nation's National Energy and Climate Plan (PNEC 2030) envisages the development of a substantial offshore wind capacity in the next decade, marking a key component of the country's broader energy transition strategy.

Investment in maritime infrastructure, regulatory frameworks, and collaborative ventures with neighboring countries are all parts of Portugal's strategy to leverage its extensive coastline for clean energy generation.

Portugal has been at the forefront of renewable energy development, with a significant portion of its electricity generation coming from renewables, including hydro, solar, and onshore wind. While the country's offshore wind efforts haven't been as pronounced as some of its Northern European neighbors, there have been advancements in the sector.

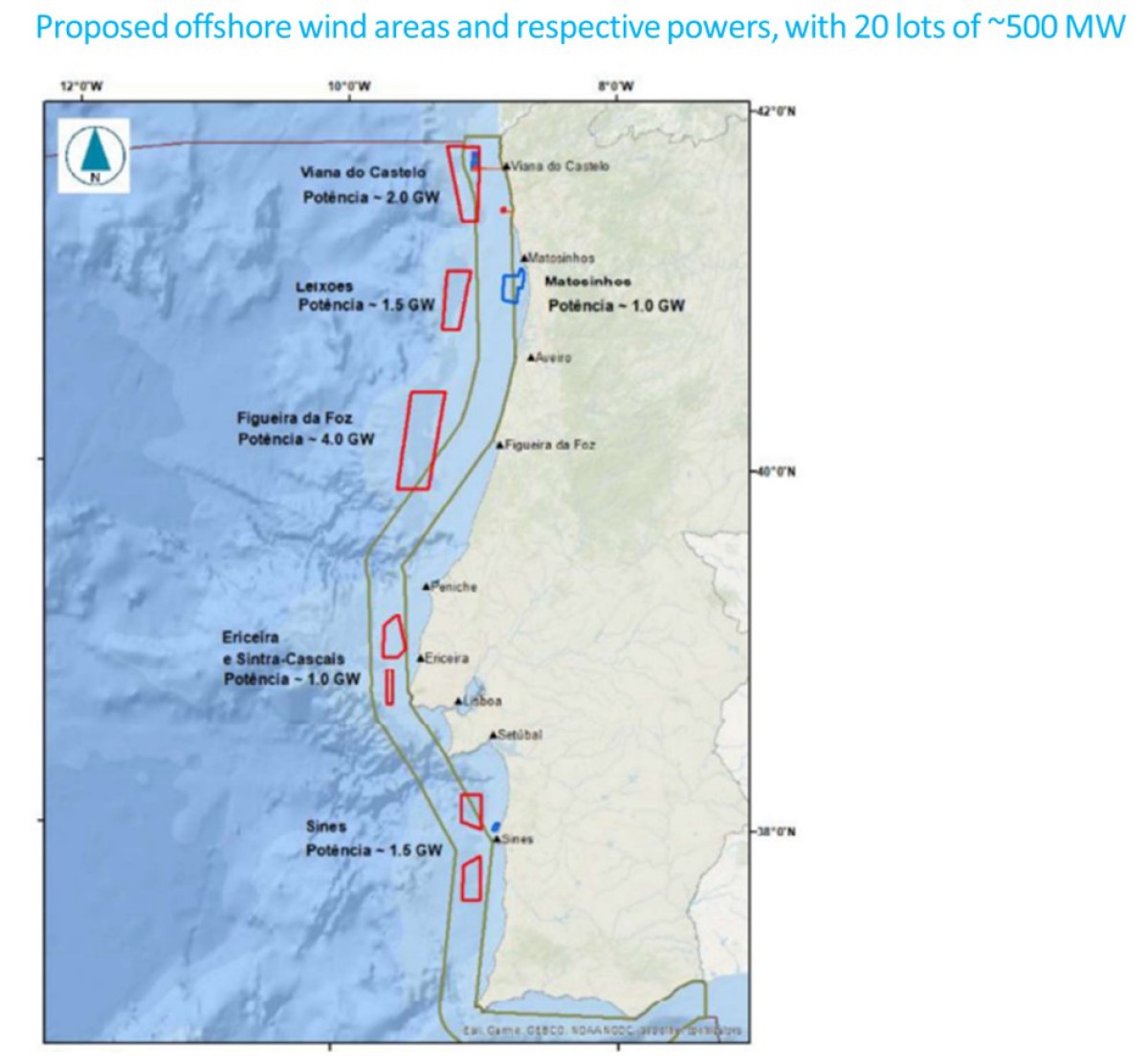

In a technical report released publicly, LNEG estimates Portugal technical offshore energy potential as 38 GW (36 GW floating +2 GW fixed), considering the energy resource available and the geographic, environmental and sea use limitations.

Among other revised renewable energies, in total, in 2030, Portugal should have an electricity production capacity of 47 GW, above the 32 GW foreseen in the NECP in force and well above the 23 GW of installed capacity today.

Technological Innovation: Towards a Greener Tomorrow

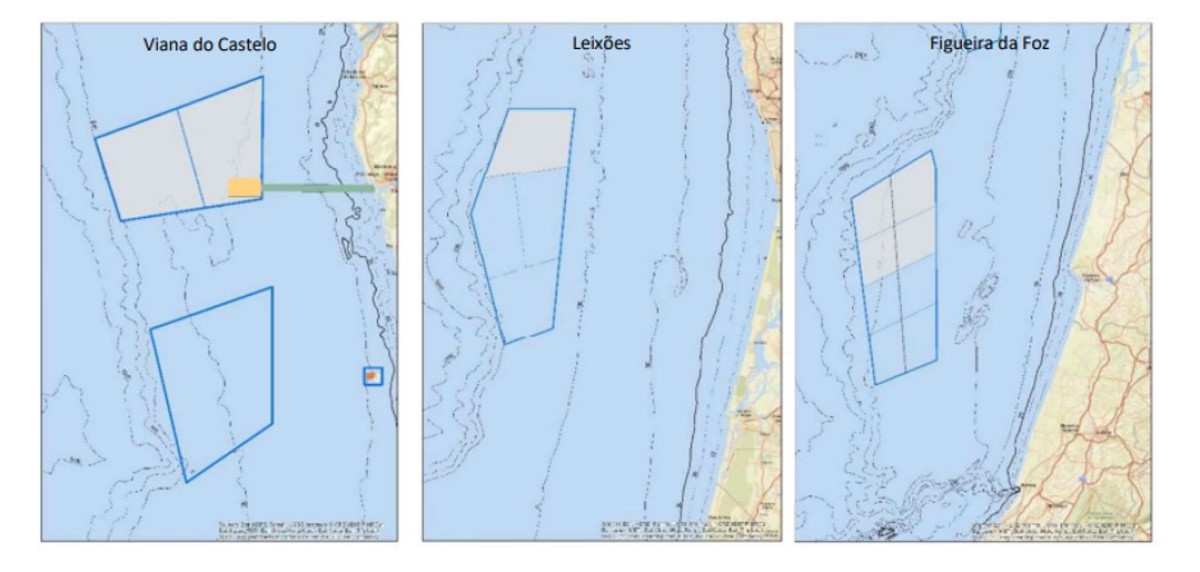

The technology underpinning offshore wind in Europe and Portugal is both innovative and competitive. Floating wind turbine technology, in particular, offers a promising solution for the nation's deep-water coastline. Portugal has already shown its dedication to this technology with the inauguration of the WindFloat Atlantic project near Viana do Castelo, the world's first semi-submersible floating wind farm.

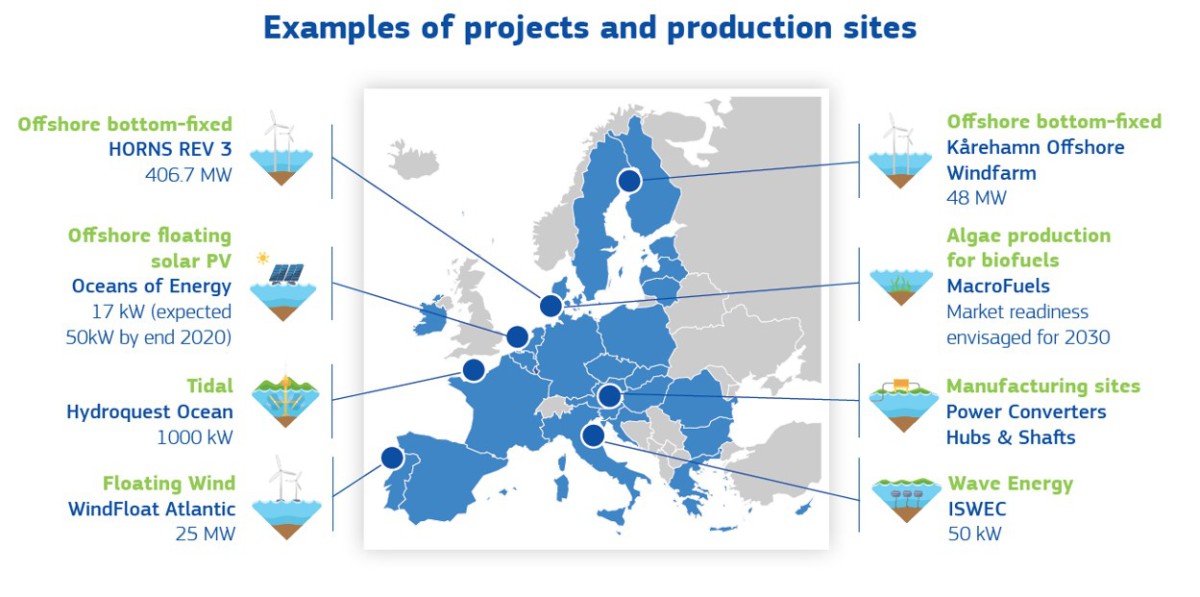

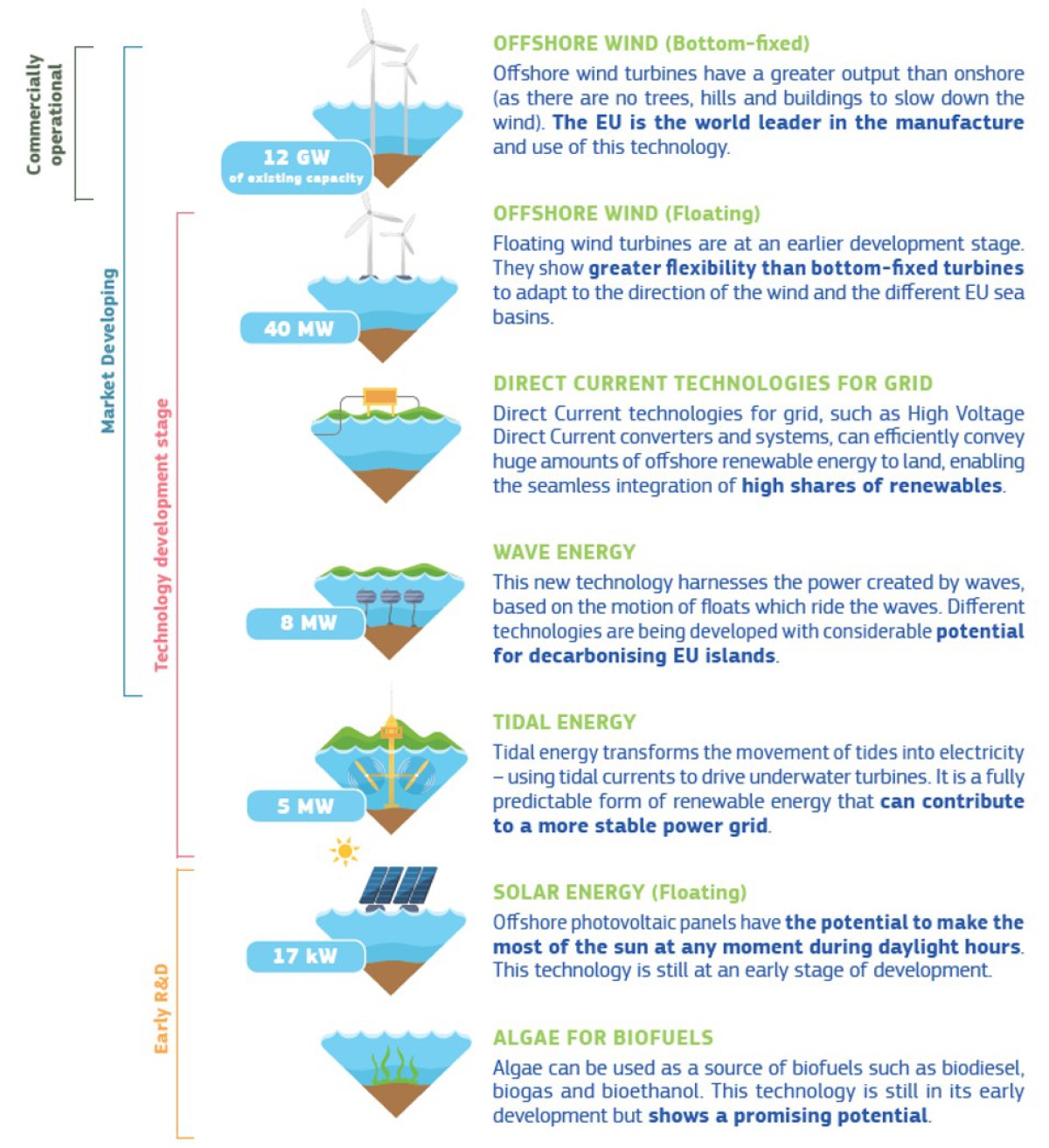

The EU offshore renewable strategy looks at a broad range of technologies. Some of them are already well advanced, while others are still on their way to the commercial stage.

The EU offshore renewable strategy looks at a broad range of technologies. Some of them are already well advanced, while others are still on their way to the commercial stage.

Market Evolution: A New Dawn in Energy Mix

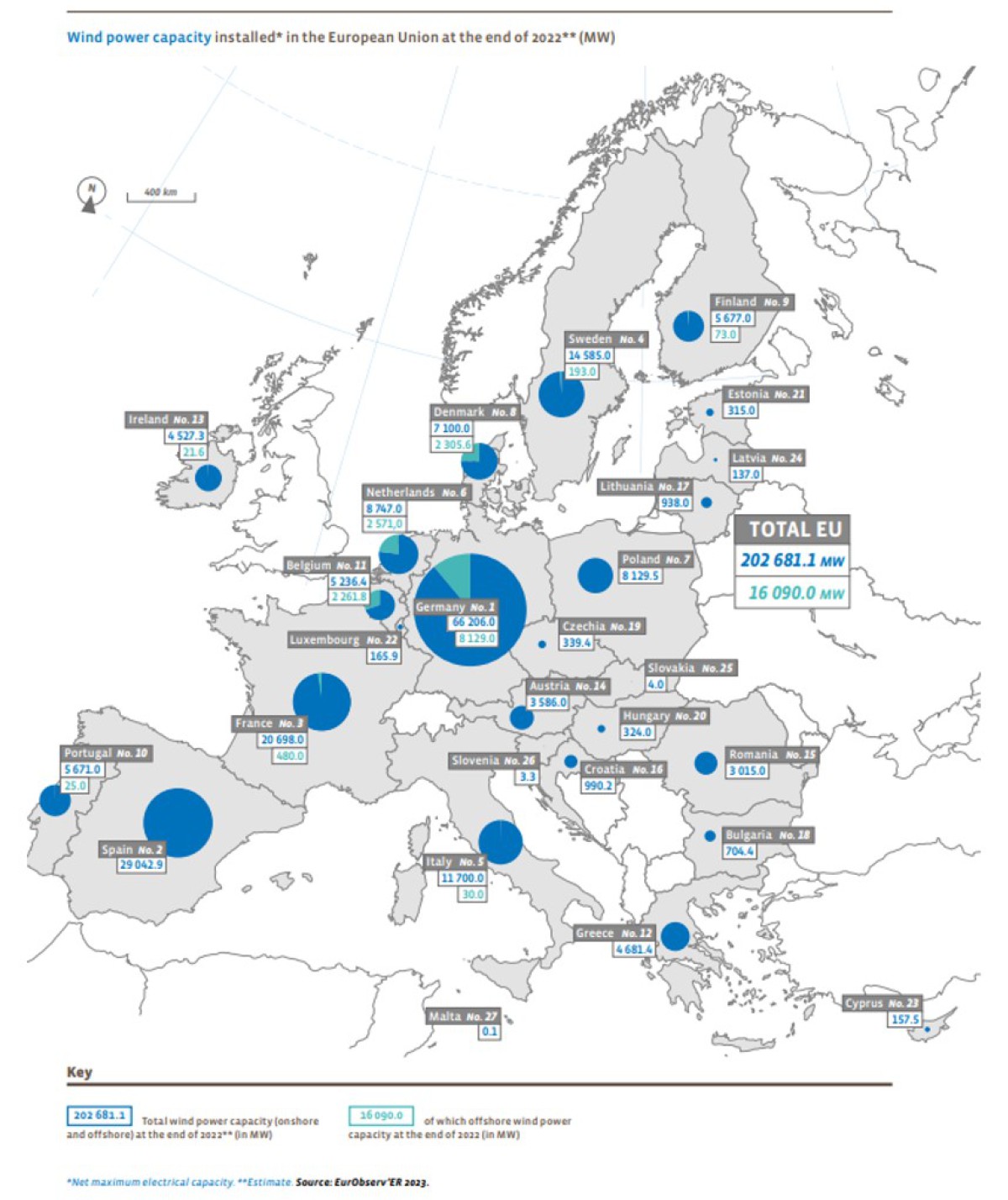

Offshore wind energy's role in the European, especially in Germany, Netherlands, and Belgium, and Portuguese energy matrices is witnessing an unprecedented ascent. From a relatively modest share just a decade ago, offshore wind now constitutes a growing fraction of the EU's energy mix.

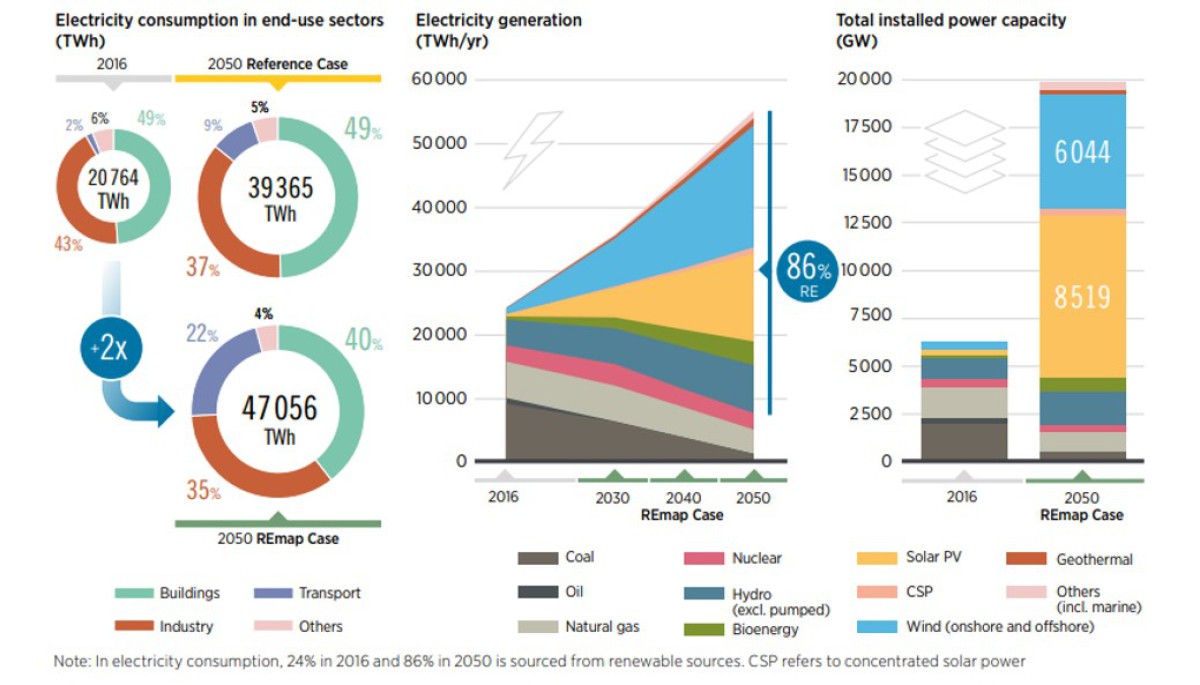

In fact, the power sector would more than double in size by 2050 and would be fundamentally transformed due to the addition of over 14 000 GW of new solar and wind capacity. By 2050, wind and solar power will dominate in renewable-based generation. The sector will need greater flexibility to accommodate the daily and seasonal variability of solar and wind power.

In fact, the power sector would more than double in size by 2050 and would be fundamentally transformed due to the addition of over 14 000 GW of new solar and wind capacity. By 2050, wind and solar power will dominate in renewable-based generation. The sector will need greater flexibility to accommodate the daily and seasonal variability of solar and wind power.

Portuguese Auctions: A Market Catalyst

In a move to accelerate the transition and attract global investors, Portugal has commenced auctions for offshore wind farm projects. These auctions not only validate the country's commitment to renewable energy but also establish a competitive market, ensuring that the nation secures the best technological solutions at the most favorable prices.

Portugal has big ambitions in offshore wind, especially on floating. The authorities have set up working groups within three key areas: (i) marine space, (ii) port infrastructure, and (iii) grid connection.

Portugal discloses areas for offshore renewables, and it will launch its first offshore wind energy auction this year.

The auction is expected to take place in autumn 2023. The Government is also underway on a set of regulations for the allocation of areas and the auction model.

The first auction will include Viana do Castello, Leixões, and Figueira fa Foz, in a total of 3.5 GW, in the following locations:

It will be a centralized competitive procedure with receipt of capacity reservation title and title of private use of maritime space.

Grants to accelerate the sustainable development of offshore wind projects

- Horizon Europe: it publishes each year several calls for proposals, which, amongst others, also covers specific topics in the field of offshore renewables. Each work programme is designed for 2 years and is established with topics, amongst others, in the field of energy supply, energy systems and grids, energy storage and climate science and solutions. In Horizon Europe, the base funding rate for companies is up to 70% of eligible project costs for innovation actions (Technology Readiness Level 6/7). For research and innovation actions (up to TRL 5), the funding can be up to 100% of the eligible project costs;

- EU Innovation Council (EIC): supports game-changing innovations throughout the lifecycle from early stage research to proof of concept, technology transfer and the financing and scale up of start-ups and SMEs. Although the EIC Accelerator (TRL 6-9) is the main EIC instrument, there are also options for lower TRL projects through the EIC Pathfinder (TRL 1-3) and EIC Transition (TRL 3-5).

Type of finance provided:

/ Pathfinder (TRL 1-3): Grants of up to €4 million

/ Transition (TRL 3-5): Grants up to €2.5 million

/ Accelerator (TRL 6-9): Grants up to €2.5 million + equity up to €15 million

- Innovation Fund (IF): it is designed to scale up innovative clean tech and to finance the demonstration of first-of-a-kind highly innovative projects with highly positive impact towards the decarbonization. The IF supports up to 60% of the relevant costs of the projects, and OPEX when considering large scale projects (> EUR 7,5 million).

Portugal also have support for green investments in this field, as:

- Contractual investment regime: up to 60% of the investment in business innovation (projects greater than EUR 25 million) or acceleration of strategic investments as operations with a value of less than 25 M€ and implemented until December 31, 2025, declared as structuring for the transition towards a carbon-neutral economy, encouraging:

- Production of equipment relevant to the transition: batteries, solar panels, wind turbines, heat pumps, electrolysers and carbon capture, utilization and storage (CCUS) equipment; or

- Production of components designed and used primarily as direct inputs for the production of such equipment;

- Production or recovery of critical raw materials related to the production of the equipment and components described [(i) and (ii)].

- Business innovation (only SME): it will support up to 40% of the investment (non-reimbursable) in machines/equipments, computer equipment, building and construction for, mainly, create a new establishment or increase of the capacity or adapt an existing establishment.

- FTJ Médio Tejo (only non-SME in certain locations of Portugal): up to 40% of the investment for non-SME, which will accelerate strategic investments as the production of equipment relevant to the transition: batteries, solar panels, wind turbines, heat pumps, electrolysers and carbon capture, utilization and storage (CCUS) equipment;

In conclusion, as Europe reimagines its energy landscape, Portugal is positioning itself as a beacon of sustainable development. With a clear strategy, innovative technology, and a growing market share, the nation's offshore wind energy prospects shine brighter than ever.