Production and potential of biomethane

European Biomethane Strategy

To reduce its reliance on Russian fossil fuels, the REPowerEU plan further increases the ambition level beyond the Fit-for-55 Package for gas alternatives (biomethane, renewable hydrogen), deployment of renewables, and structural demand measures.

The future energy mix is predicted to be dominated by wind and solar power, both as generators of electricity and in the production of hydrogen (H2). Yet biomethane also has a relevant role to play to decarbonize the EU's energy system, because is one of the main renewable gases of the future and available today. It’s the cheapest and easiest to scale form of renewable gas.

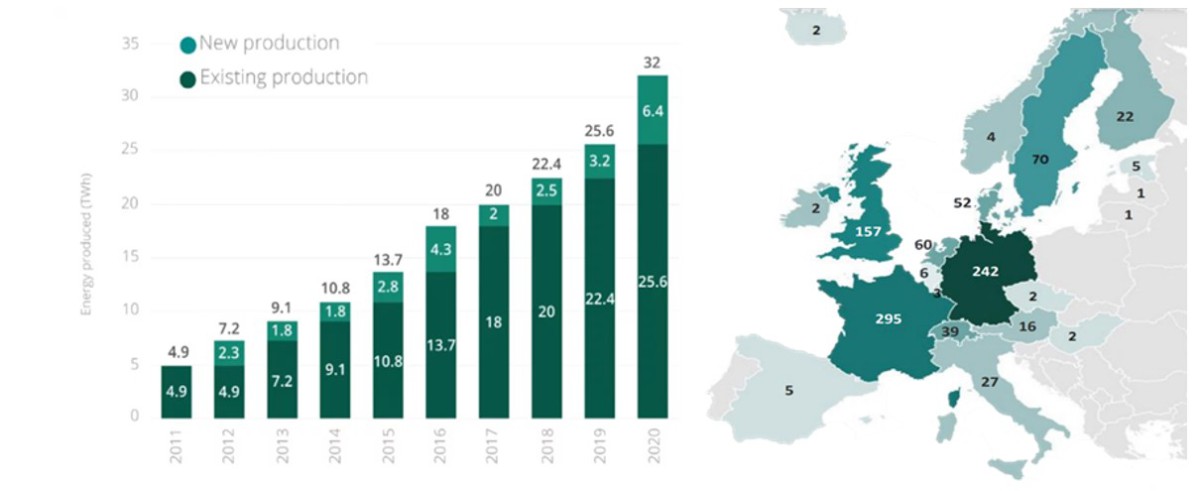

Biomethane is a near-pure source of methane produced either by upgrading biogas or through the gasification of solid biomass followed by methanation.

- Anaerobic digestion (AD)

Anaerobic digestion is the process in which microorganisms (as bacteria) biodegrade organic materials (e.g., solid animal manure, biowaste and food waste) in the absence of oxygen, resulting in biogas, which contains around 55% methane and the rest being mainly carbon dioxide (CO2).

The biogas can be upgraded to biomethane, by removing CO2 and other gas impurities.

Then the biomethane can be injected into the gas grid to substitute natural gas. The CO2 could be captured and used in industry (e.g., beverage industry).

Biomethane production through anaerobic digestion and its upgrading is a proven and market-ready technology. Costs today range from 50 EUR/MWh to 90 EUR/MWh and largely depend on the feedstock used and plant scale. There are almost 20,000 biogas plants operating in Europe today and almost 1,000 of them upgrade and inject biomethane into the natural gas grid.

- Thermal gasification

Thermal gasification involves a complete breakdown of dry lignocellulosic biomass (e.g., woody biomass, and agricultural residues) and municipal solid waste, at high temperature in a gasifier in the presence of a controlled amount of oxygen and steam.

Biomass gasification with biomethane synthesis is not yet commercially available and only exists at demonstration scale, for example, the Gaya project in France. However, the potential to scale up is large in the mid-term (2030 and beyond).

Costs today are estimated to average around 85 EUR/MWh, based on a plant size of 20 to 40 MW, and, in the future, could cost around 60 EUR/MWh .

Both technologies and selected feedstocks characteristics (e.g., pH, temperature, humidity level, and nitrogen) have influence in the quantity of gas obtained and its chemical characteristics.

For the described reasons, the European Commission fully recognizes the biomethane benefits and thus set a target of 35 billion cubic meters (bcm) of annual production by 2030 and 95 bcm by 2050.

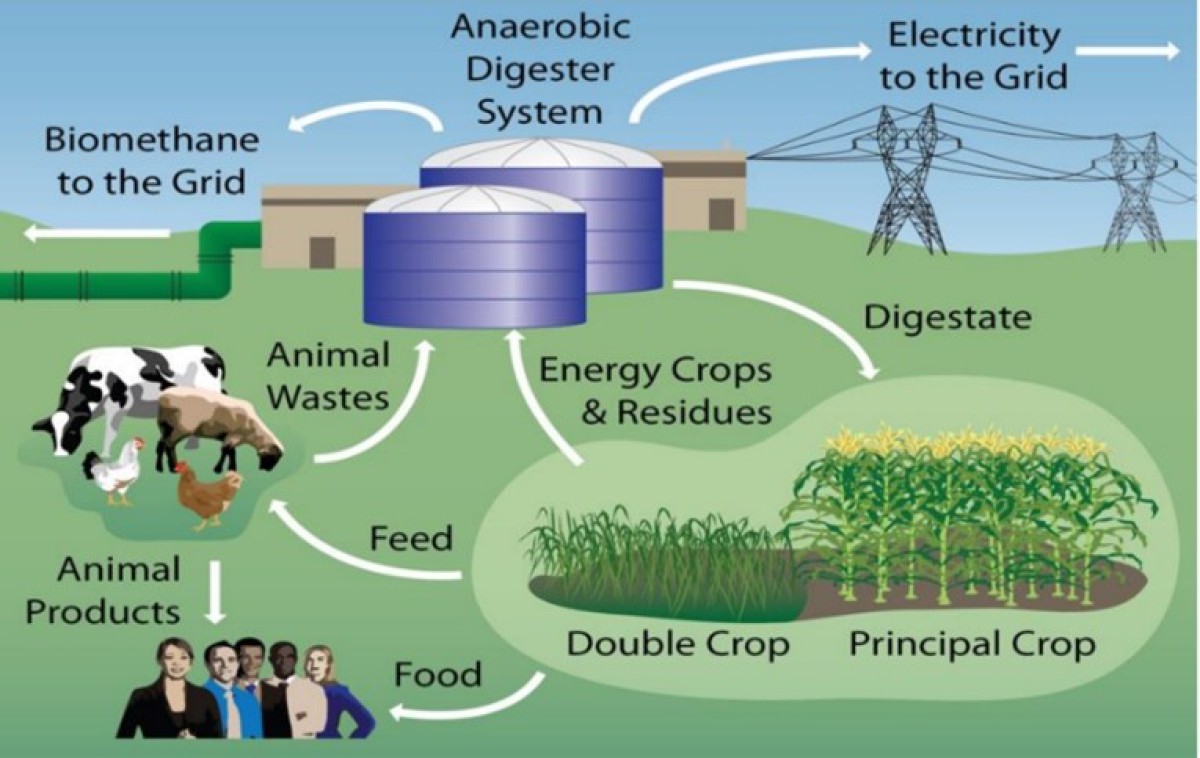

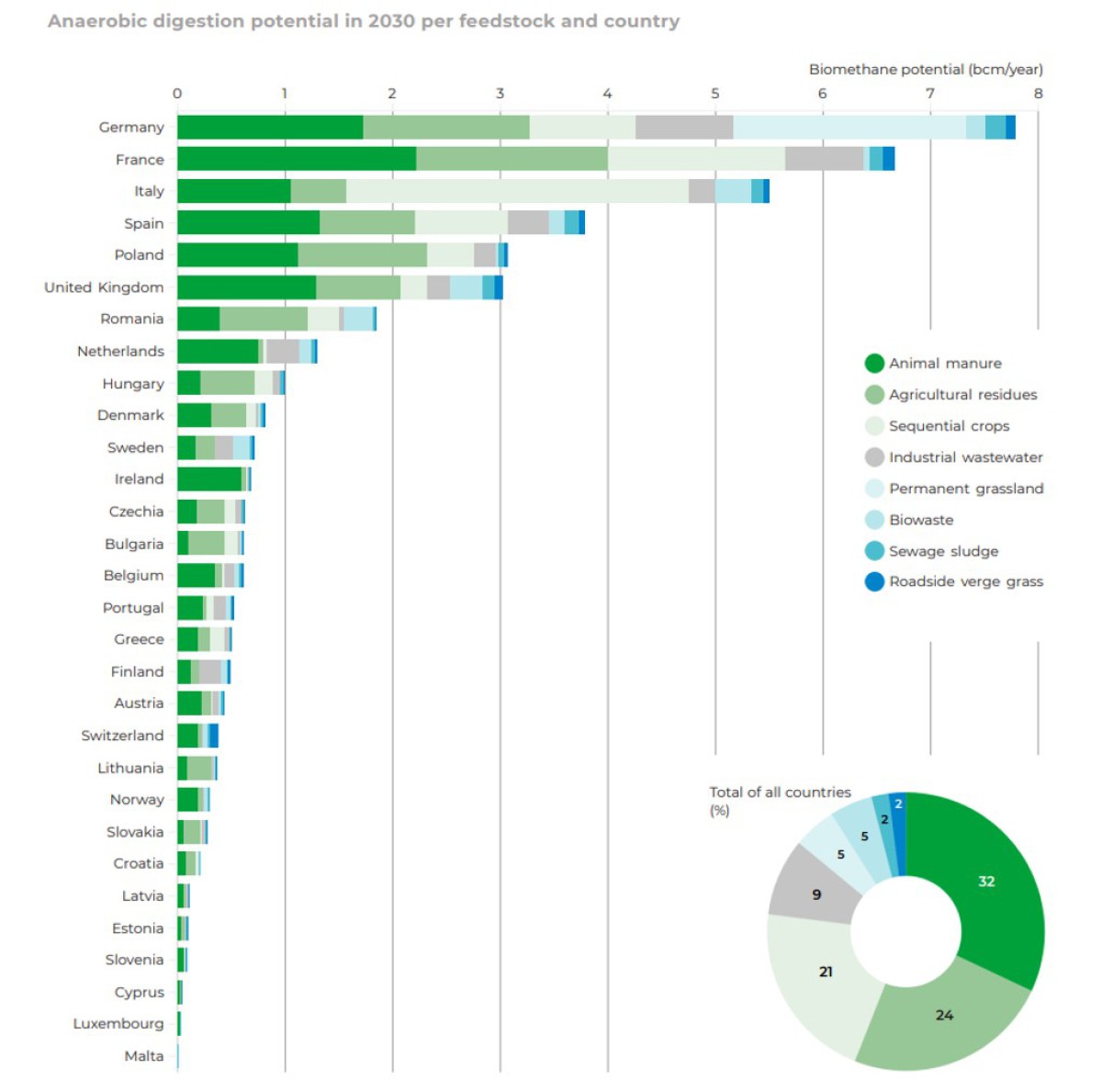

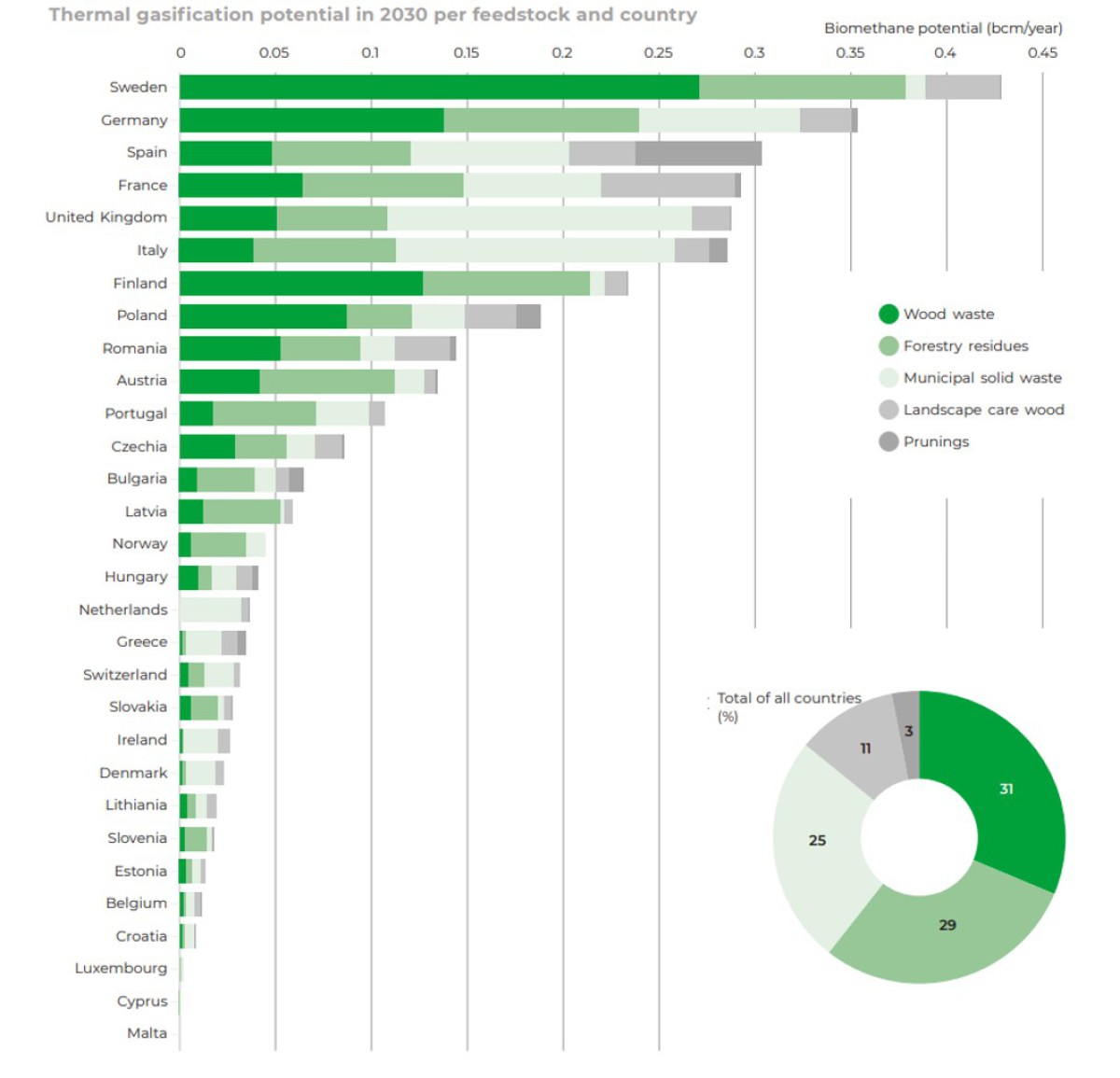

Based on sustainable feedstocks, in the follow figure are showed the potential of biomethane production in each EU Member State (plus Norway, Switzerland, and the UK) in 2030. A potential of 38 bcm is estimated for anaerobic digestion in 2030 for EU-27, while for thermal gasification a potential of 3 bcm/year.

Source. European Biogas Association

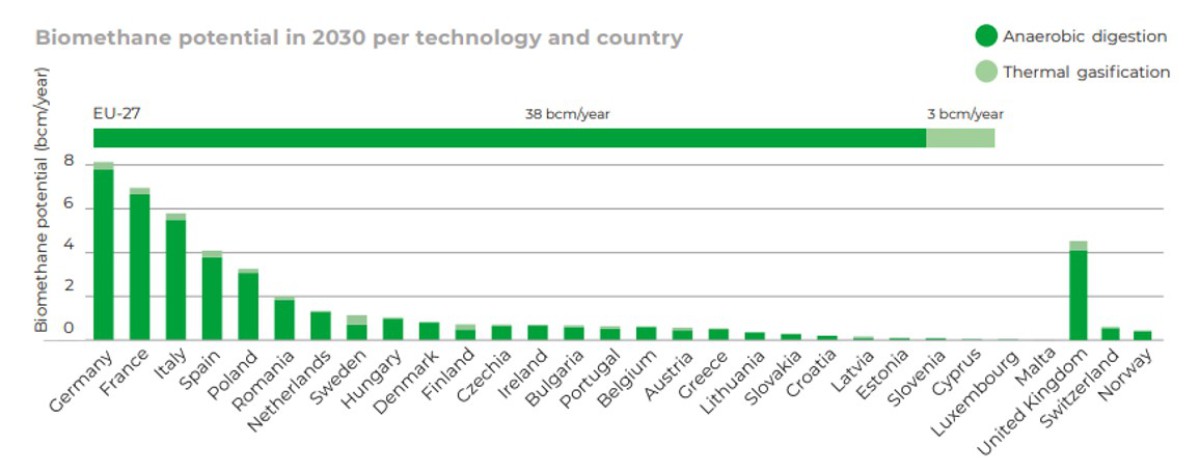

In 2021, the number of biomethane production sites in Europe reached 1023, comparing with 880 in 2020 (32 TWh).

Source. European Biogas Association

Source. European Biogas Association

The top 5 countries with anaerobic digestion potential in 2030 include France, Germany, Italy, Spain, and Poland. Key feedstocks in 2030 are animal manure (32%), agricultural residues (24%) and sequential cropping (21%).

Source. European Biogas Association

In the other hand, the top 5 with thermal gasification potential in 2030 include France, Germany, Spain, Sweden, and the UK. Key feedstocks are forestry residues and wood waste, which collectively represent over 60% of the potential.

Source. European Biogas Association

Turning Chicken Litter into Biomethane

STREAM develops extensive market and technological research about the conversion of chicken litter into biomethane through high solid - anaerobic digestion/dry anaerobic digestion.

The following findings stand out:

- 4-10 times less water than other technological solutions (e.g., wet anaerobic digestion);

- Dry matter / total solids 20-40% (100-140 m3/ton) compared to 20% maximum for wet digestion;

- Low power and heat needs;

- Very tolerant system for contaminants (sand, fibers, large particles, etc.);

- Less critical equipment (pumps, agitation systems, feeding equipment);

- Less maintenance required.

While there are still some improvement opportunities:

- Chicken manure is difficult to degrade into biogas efficiently;

- Ammonium inhibition resulting due to increase ammonium in manure and limited techno-economic viability of techniques used to remove it;

- Anaerobic digestion of chicken manure as the dominant substrate in the biogas plant reactor feedstock mix has been problematic due to its high nitrogen content, causing inhibition of anaerobic digestion process when high organic loading rate is applied to the digesters. Chicken manure has a higher nitrogen content than food waste, cow manure, pig slurry or waste activated sludge;

- Chicken manure is a chemically unstable feedstock;

- Another factor affecting the process might be the storage conditions as well as storage time of the chicken manure.

In recent years, researchers focus on enhancement of chicken manure mass usage as the biogas production feedstock. The major methods found in the recent publications of chicken manure digestion are:

- Codigestion with other organic feedstocks (e.g., carbon rich biomass such as lignocellulosic biomass);

- Chicken manure pre-treatment;

- Digestate post-treatment for the sake of ammonia stripping.

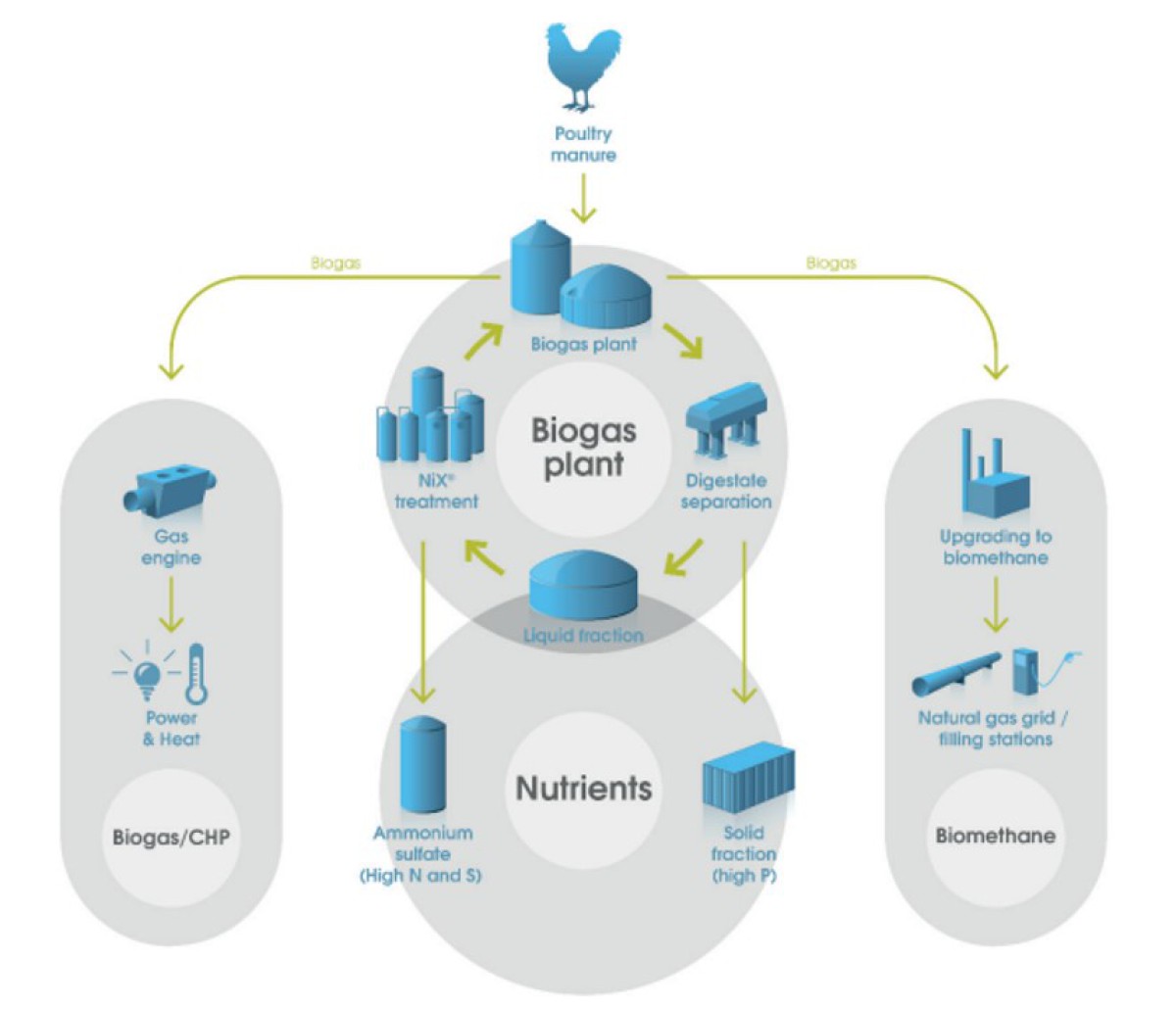

A Case Story: The Tully Biogas Plant Generates renewable energy from chicken litter

The Tully Biogas Plant, located near Ballymena in Northern Ireland, is one of the first facilities in the world that generates renewable energy from chicken litter as the sole feedstock using an innovative combination of anaerobic digestion and nitrogen stripping technology.

With a construction cost of £23 million this plant processes up to 40,000 tonnes of locally sourced chicken litter each year and generates 3MW of renewable electricity.

The plant was developed by Stream BioEnergy and Xergi, a Danish specialist supplier of large-scale biogas plants, was responsible for the design and delivery of the plant. Xergi is also responsible for the operation of the plant.

The processing of chicken litter through conventional AD systems has been historically challenging due to the elevated nitrogen present in the litter which inhibits the digestion process. To prevent this, chicken litter (15-25%) is normally digested together with other feedstocks (75-85%) which have lower nitrogen content.

- Feedstock Reception and Pre-treatment: when offloaded inside the building chicken litter is fed into mixing tanks for blending with fresh water and recirculated digestate liquid;

- AD Process: feedstock in the mixing tank is pumped to primary digestion tanks. Digestion takes place in a two-stage process. The digesters are operated at mesophilic temperatures of 37°C and the total digestion time is 35 days. Following digestion, digestate is pasteurized at 70°C for one hour to satisfy Animal By-Product Regulations;

- Biogas Treatment and CHP: biogas generated in the digestion tanks is stored in the tank roof spaces and in two gas holder domes. Biogas is cooled to remove any condensate before use in gas engines to generate electricity and heat. Gas blowers boost gas pressure for input to the engines. Two 1.5 MW rated Jenbacher gas engines are installed in acoustically self-contained rooms within the main building. The electricity generated is exported to the grid, and heat recovered from the engines is re-circulated for use in the digestion and pasteurization processes;

- Digestate Management: following pasteurization, the whole digestate is pumped to the separation plant where it is partitioned into solid and liquid fractions using decanter centrifuges. The solid fraction is transferred from the site to horticultural markets with a demand for this nutrient rich product. Most of the liquid fraction is treated in Xergi’s patented nitrogen stripping process, NiX®, that denitrifies the liquid so that it can be used to dilute the incoming chicken litter. The NiX® nitrogen stripper utilizes sulphuric acid which results in the creation of an ammonia sulphate solution that is pumped to a storage tank before being exported off site for use as a concentrated ammonium fertilizer that can replace artificial nitrogen fertilizer.

Source. IEA Bioenergy

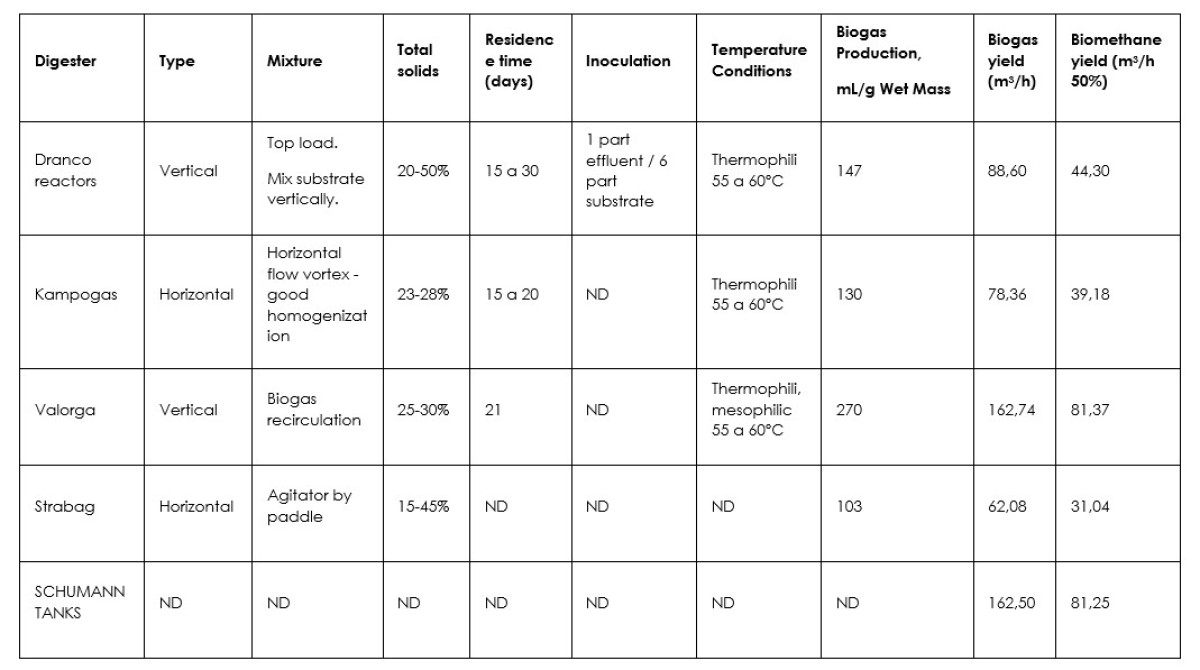

Dry anaerobic digestion technologies and its characteristics

Strategies to scale-up biomethane?

The rapid scale-up of biomethane will need more recognition and support from Member States, through ambition level of policies supporting gas decarbonization, and realizing, as a strategic vector, the potential to recycle their wastes and residues for sustainable gas and biofertilizer production.

By 2024, EU countries must collect separately organic waste, which will be an opportunity to upscale the production of sustainable biomethane and create income opportunities for farmers and foresters. In Portugal, this is highlighted in Plano Estratégico para os Resíduos Urbanos 2030 (PERSU 2030) and aligned with other legal frameworks.

Additionally, the use of manure for biomethane production can also play an important role in reducing fugitive methane emissions in the agricultural sector. These benefits need to be also recognized by policy makers.

The actions should also create the preconditions for sustainable upgrading and safe injection of biomethane into the gas grid. The EU has already created well-functional trading conditions for renewable electricity. The gas sector needs similar mechanisms to trade volumes and Guarantees of Origin of renewable gas across borders.

Another proposed action includes the assessment of challenges, bottlenecks, and other possible measures from the infrastructure perspective for a cost-efficient deployment of biomethane. Moreover, national authorities, TSOs and DSOs should assess potential investment challenges to increase the uptake of biomethane and connect decentralized production sites with consumption centers over large distances.

Biomethane is needed to complement renewable electricity, and green hydrogen is currently not widely available and at least until 2030 the costs will be high.

The Commission will consider broadening the scope of the fuel supply obligation in the Renewable Energy Directive to cover all uses of biomethane. The Commission's recommendation on permitting should also facilitate new biogas and biomethane investments.

This will include streamlining existing funds and funding mechanisms such as common agriculture policy, structural and cohesion funds, national resilience and recovery plans, Horizon Europe or the innovation fund and the modernization fund, LIFE funding and other national funding opportunities. In Portugal, under “support for renewable gases production”, there are already incentives for biogas upgrading into biomethane.

For further details please contact our Energy team: energy@streamconsulting.pt