Voluntary Carbon Market

At a time when the fight against climate change is on the agenda of governments, institutions and economic operators, the voluntary carbon markets have been attracting more and more interest.

The Decree-Law, which establishes the voluntary carbon market and sets out the rules for its operation, is in public consultation until April 10th 2023.

This will be an active instrument in Portugal, either on the supply side, to promote emission reduction or carbon sequestration projects that generate carbon credits, or on the demand side, to acquire the credits to offset residual emissions or to ensure financial contributions in favor of climate action.

This market will have 3 main players:

- The promoters of GHG (Greenhouse Gases: carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons and sulfur hexafluoride) emission mitigation projects;

- The individuals and organizations, private or public, that acquire or use carbon credits;

- The entities responsible for certification and validation.

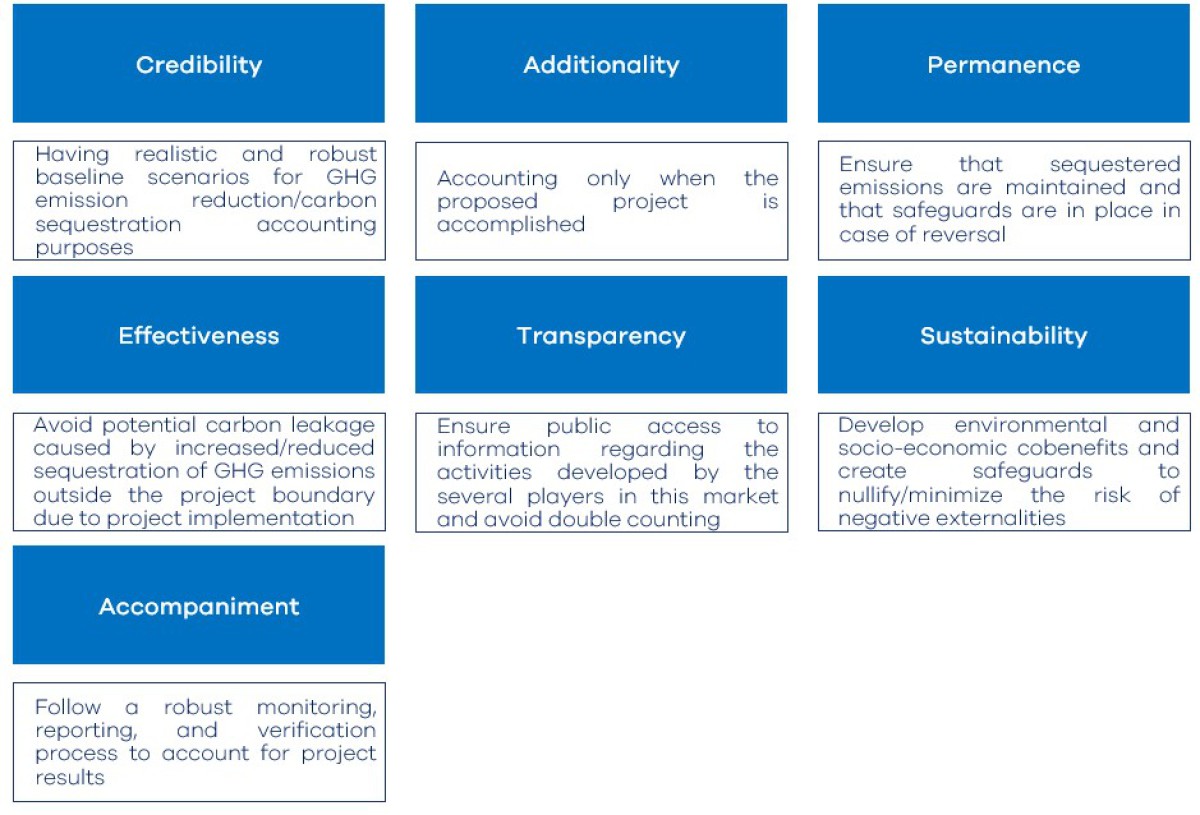

These will be regulated by the following fundamental principles:

It is considered as priority projects those that contribute to the conservation of natural capital and to the construction of a more adapted and resilient landscape, particularly those developed in vulnerable territories, Forest Intervention Areas, wastelands and burnt forest areas or other areas that, due to their nature, need intervention, identified by ICNF or APA.

Thus, the promoters who wish to develop a carbon project and see the credits generated recognized should:

- Develop a descriptive report about the project;

- Obtain validation of the project by an independent verifier, duly qualified (ex-ante evaluation);

- Proceed to register the carbon project on the registration platform, to be developed by APA;

- Ensure the correct implementation of the project;

- Communicate changes to the project;

- Guarantee compliance with monitoring, reporting and verification conditions (e.g. periodic monitoring report to be made available by the APA and ex-post evaluation).

GHG emission reductions or carbon sequestration obtained through projects in the voluntary carbon market generate future or verified carbon credits, corresponding to 1 ton of CO2. Each credit issued has a unique serial number to enable its traceability.

Carbon credits can then be tradable, and the credits flows between market agents must be registered in a platform for this purpose. The use of carbon credits can take the form of: emission offsets or contributions to climate action, and credits must be cancelled.

The offsetting of emissions by an organization should be part of a clear strategy to decarbonize and reduce the organization's GHG emissions in order to achieve carbon neutrality in a medium-long term perspective, in line with national and international climate action targets. After accounting for the GHG emissions associated with their activities, organizations that so choose may offset the residual emissions that cannot be reduced or avoided through the acquisition of carbon credits. The carbon neutrality commitments assumed by organizations should have underlying a transparent and verifiable mechanism for accounting and offsetting emissions that allows the measurement of the progress made in fulfilling these commitments.

Note that carbon credits cannot be used or claimed for compliance with European or international obligations, including for the purposes of the European Emissions Trading Scheme and the International Aviation Carbon Offsetting and Reduction Scheme, or for compliance with nationally determined contributions of any other party to the Paris Agreement

Fees will be charged for opening and maintaining an account, registering projects on the platform, trading carbon credits, and approving methodologies proposed by market agents.

For more information, see:

https://www.consultalex.gov.pt/ConsultaPublica_Detail.aspx?Consulta_Id=284